OUR STORY

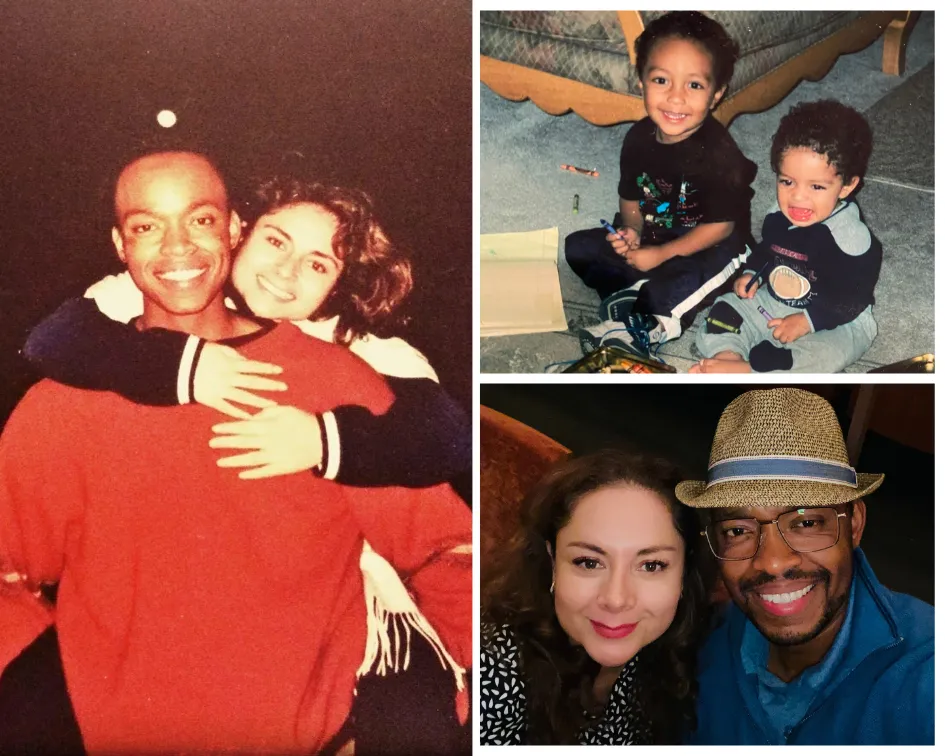

Jason Atwood

Financial struggles can hamper many marriages. If you try to do some research on marriage conflicts, you will certainly discover that money is a big source of conflict in marriages. And that's why financial problems are a leading cause of divorce today. Many people don't realize that financial challenges can actually begin even before you say " I do"

How married people deal with financial challenges in their marriage is what really matters . Well, things do happen and one partner might lose a job and then the whole relationship goes into a crisis. But how do you address the issue? well, I'll tell you about my Story .

My wife and i got married in 2000 while i was till in college. that tells you we got married at a very young age. At that time i had a job managing some student housing at night.

Since the money was very tight, we could only afford to live in a very small apartment. I could try to work ramdin Jobs here and there just to try and make ends meet, and especially because we were expenting our firts child

By the second year of our marriage, we had two kids already and a lot of bills to be paid. As a result, I dropped out of college in my seniro year for a while and got into multiple business ventures, ehereby some were good and most were awful. Our bills kep increasing and our financial struggeles kept soaring. We were doing very badly. Debt started to be a major issue in our lives, stress became part of our lives, and the fights and pain were too much to bear. We needed to find a solution. Thats when we found these principle as a guide to get us on the right path. By following these guiding principle of wisdom we began to eliminate the debt and get ahead in life. I hope these principles can help you and your family , as well.

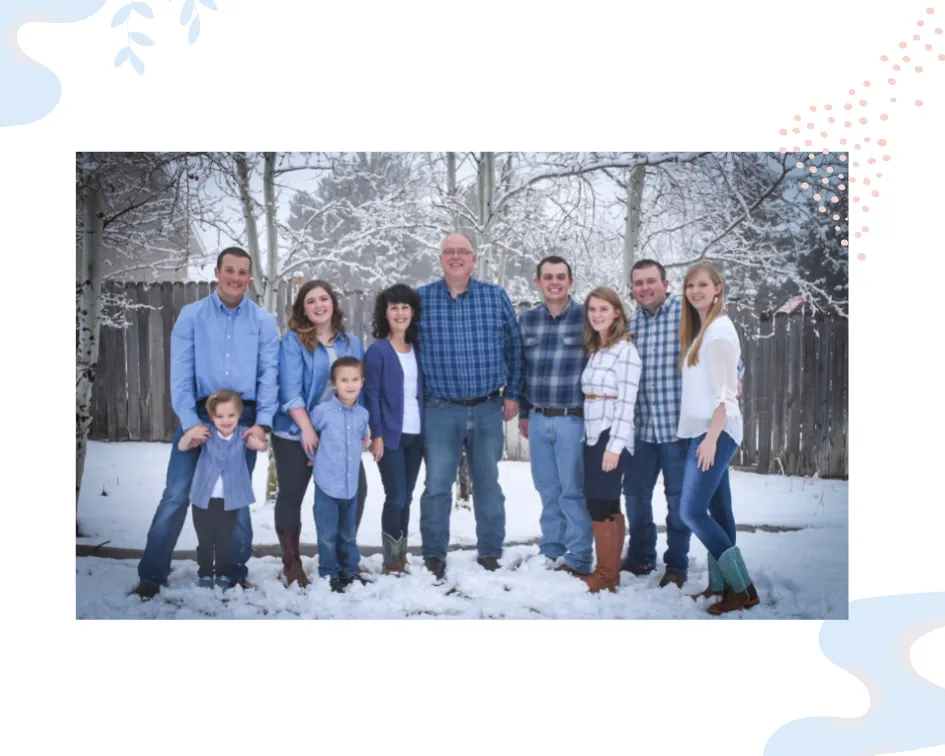

Lance Stalling

In 2003 my wife and I and our four children, one a new born. I had left my Job to start a new business. We were living in a home that owed $144,000 on , with and interest rate of 7.2% with a monthly payment of $1371. We had two auto loans and two credut cards, our total short-term indebtedness was 32,000. At the time, I was making about $65,000 taking home about $40,000 a year, After taxes and healthcare we were barely getting by.

We decided to implement the 70/20/10 Rule. We took a hard look at what we were making and committed ourselves to the process. The lowest short-term debt balance was on a credit card, so we applied the extra 20% to that credit card payment . The next was an automobile, and so forth. In the course of 24 months , we had repaid the $32,000 of consumer debt. `

We had two types of loans on our home, a first mortgage and a second interest only home equity line that had a ten-year balloon payment . With all of our short-term debt paid, we then were able to make triole monthly payments on hour home loans. Over the next five years , we paid off $144,000 on our home and were now free and clear.

Over the last ten years. we have continued to live the 70/20/10 Rule . However, instead of using the 20% to pay off debt , we are now able to put away that amount for the future purchase and retirement. We Know that we're going to have weddings and college to pay for . The 70/20/Rule has allowed us to make those purchases withouth going intodebt. We have paid cash for automobiles, cash for vacations, cash for christmas, ans we've been able to help several people along the way. For the most part. we live a stress-free financial life . Not because we have a lots and loots of money, but because we manage the money we have well. You can do this too. Take the tine to build your Smart Financial House